ESCROW INSPECTIONS & APPRAISALS

WHAT IS ESCROW?

The escrow company is a neutral third party with the responsibility of overseeing the contract to make certain that no funds or property will change hands until all conditions of the purchase contract have been met, and to make sure that the interests of all parties to the transaction are protected.

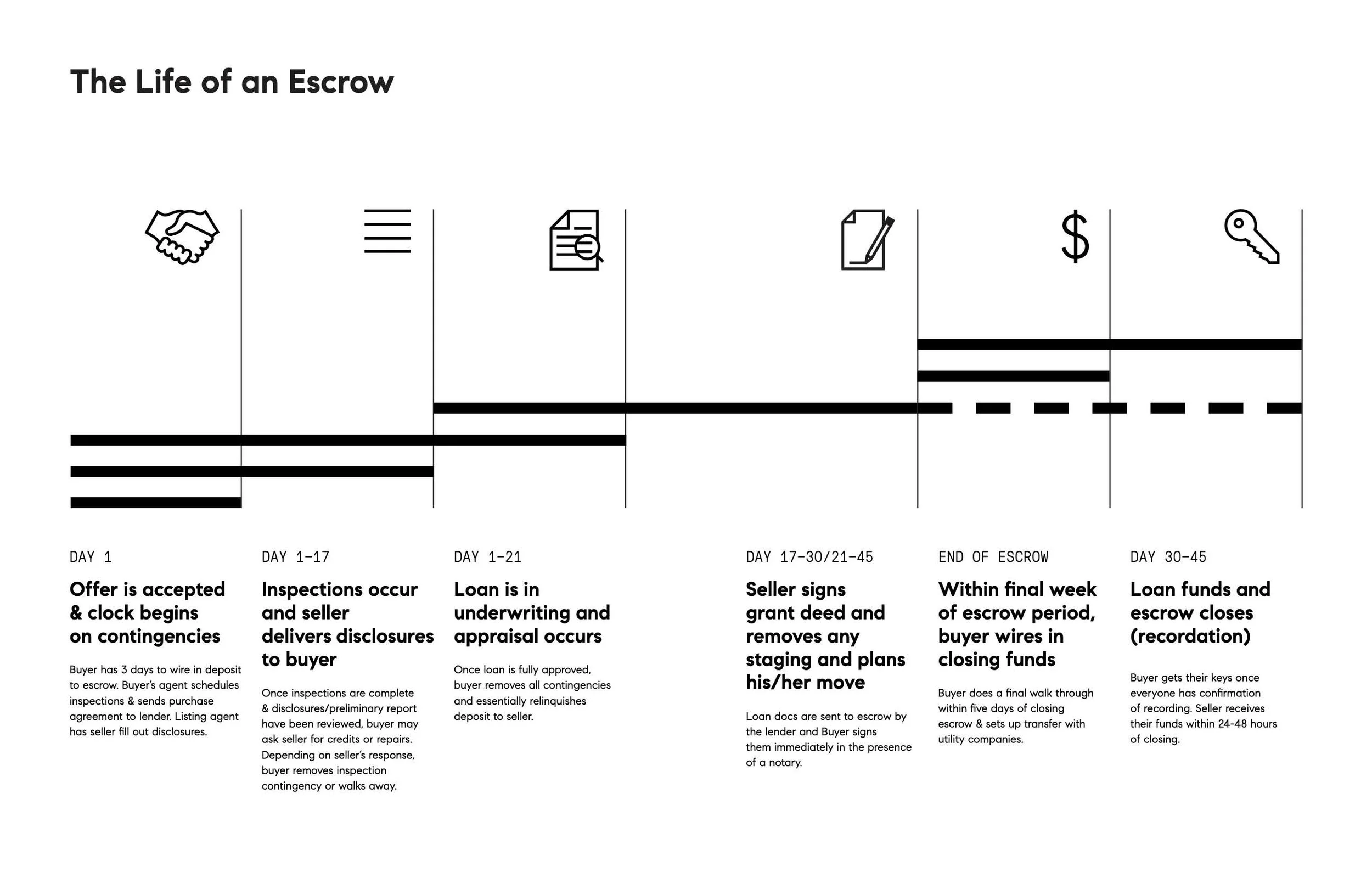

The escrow company is determined and agreed upon between the buyer and seller (this is a negotiable item as with all the other terms of the contract). Upon acceptance of the RPA by buyer and seller, the escrow process begins and the contract is now officially active. The Realtors® will provide the purchase agreement to the escrow holder and include the contact information for all parties. The escrow holder then reviews the contract, reaches out to the buyer and seller, and provides wire instructions for the buyer’s earnest money deposit, which is typically 3% of the purchase price.

The earnest money deposit is due into escrow no later than three business days from acceptance, and is held in-trust by the escrow company.

After reviewing the contract, the escrow officer will prepare the escrow instructions. These instructions outline the duties of the escrow holder and incorporate the legal description of the subject property, and include the contingency dates as agreed upon in the contract. The escrow holder will generate opening packages that contain documents that need to be signed, completed, and at times notarized. The opening package is to be returned to escrow within 5 days of receipt. Escrow is happy to help guide you through the package. The escrow officer will also open a title order, if not already done by the listing agent, and will review the preliminary title report. Escrow will work with the seller and the title company to ensure that clear title will pass to the buyer at the close of escrow. This means all encumbrances, liens, property taxes, or other obligations that may be against the property will be paid.

The escrow holder works with every party in the transaction and is a great resource to go to with any questions, updates, or concerns.

*Wire fraud is on the rise, so buyers should always contact the escrow officer by phone to confirm the wire instructions that they’ve received from escrow. This is just another measure of safety and should be a standard practice anytime funds are being wired.

It is extremely important to use an escrow company that is in compliance with the CFPB (Consumer Financial Protection Bureau). Escrow companies that are not in compliance with the CFPB can put a buyer’s and seller’s personal information at risk.

Inspections and Appraisals

Most buyers will have the property inspected by a licensed property inspector within the time frame that was agreed upon in the effective contract to purchase. Some buyers will have several different inspectors inspect the property, if they wish to obtain professional opinions from inspectors who specialize in a specific area (eg. roof, HVAC, structure). If the agreement is conditional upon financing, then the property will be appraised by a licensed appraiser to determine the value for the lending institution via third party. This is done so that the lending institution can confirm their investment in your property is accurate.

Contingencies

A contingency is a condition that must be met before a contract becomes legally binding. For instance, a buyer will usually include a contingency stating that their contract is binding only when there is a satisfactory home inspection report from a qualified inspector.

Before completing his or her purchase of your property, the buyer goes over every aspect of the property, as provided for by purchase agreements and any applicable Addendums. These include:

Obtaining financing and insurance;

Reviewing all pertinent documents, such as preliminary title reports and disclosure documents; and

Inspecting the property. The buyer has the right to determine the condition of your property by subjecting it to a wide range of inspections, such as roof, termite/pest, chimney/fireplace, property boundary survey, well, septic, pool/spa, arborist, mold, lead based paint, HVAC, etc.

Depending on the outcome of these inspections, one of two things may happen:

1. Either each milestone is successfully closed and the contingencies will be removed, bringing you one step closer to the closing; or

2. The buyer, after reviewing the property and the papers, requests a renegotiation of the terms of contract (usually the price).

How do you respond objectively and fairly to the buyer when a renegotiation is demanded, while acting in your best interests? This is when a professional listing agent can make a real difference in the outcome of the transaction. Having dealt with various property sales in the past, we guarantee our expertise and total commitment to every customer, no matter what their situation is.

Loan Approval and Appraisal

We suggest that you accept buyers who have a lender’s pre-approval, approval letter, or written loan commitment, which is a better guarantee of loan approval than a pre-qualification or no documentation from a lending institute. Expect an appraiser from the lender’s company to review your property and verify that the sales price is appropriate.